August 2025 144 Market Report

Aggregate 144 Market Volume

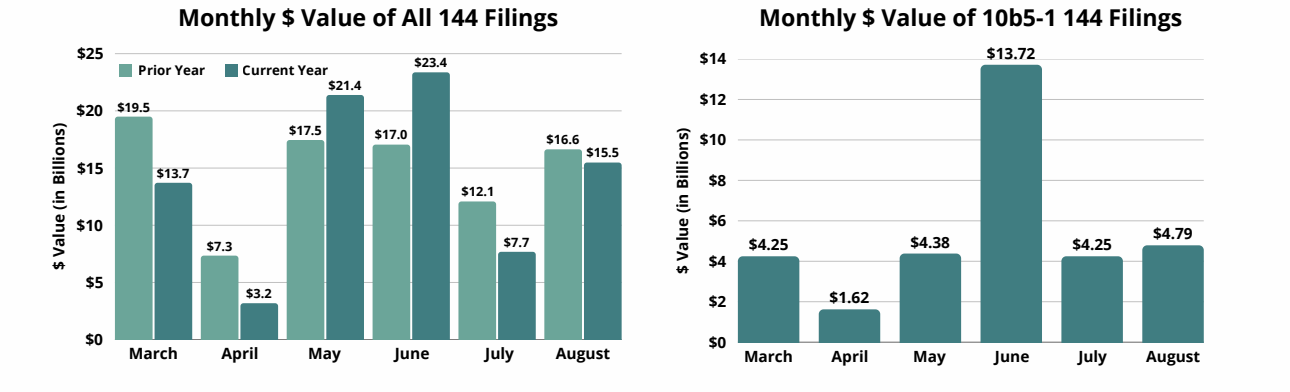

This August the total reported value of Form 144s increased over 100% from July, driven by a 212% rise in discretionary filings. There was a similar trend from July 2024 to August 2024, reflecting the end of pre earnings blackout periods and insiders’ ability to trade discretionarily again. However, this August’s numbers were largely in-line with those of 2024, specifically total reported value and number of filings. While the value of filings pursuant to Rule 10b5-1 increased 58%, that of discretionary filings fell 21% year-over-year. Insiders seemed to display more hesitancy this August than the year prior, while Rule 10b5-1 plans kicked in as the market reached new heights.

Top 5 Brokers for August 2025

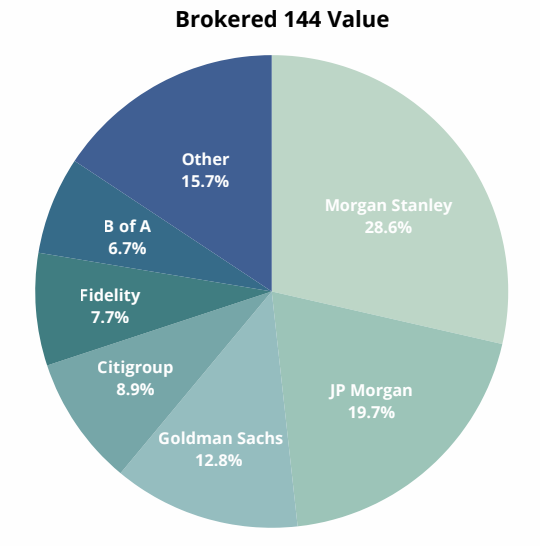

In August, Morgan Stanley maintained its first place spot in the broker rankings for value, shares, and filings. Additionally, JP Morgan came in second place for value and shares. Goldman Sachs rose to third place for value brokered, from its fourth place finish in July, due in part to their role in brokering last month’s largest filing (see next page). Citigroup advanced to fourth, and Fidelity slid to fifth place to round out August's top 5 brokers.

Top 144 Filers of August 2025

| Filer | Company | Broker | Value(M) | Shares(M) |

| Walton Family Holdings Trust | Walmart - [WMT] | Goldman Sachs | $960.8 | 10.00 |

| DK Giving Trust | CrowdStrike Holdings - [CRWD] | JP Morgan | $677.3 | 1.49 |

| SVF Investments (UK) Ltd | Coupang - [CPNG] | Citigroup | $576.8 | 20.00 |