January 2025 144 Market Report

Aggregate 144 Market Volume

In January 2025, the total reported value of Form 144s fell nearly 50% from December, accompanied by a decline in both the number of shares and filings. This is similar to the month-over-month decrease in value seen a year ago, driven primarily by a decline in the value of discretionary filings. The year-over-year comparison from January 2024 to January 2025 indicates little change in the total value brokered. There were increases in the value registered under a plan by 57% and in the number of shares filed pursuant to Rule 10b5-1 by 33%; however, these increases were offset by decreases in those same metrics for discretionary filings, by 27% and 20%, respectively. The decline in discretionary selling at the beginning of the year may indicate an overall stagnation in the 144 market when insiders are subject to pre-earnings blackout periods.

[View Full Market Report Here]

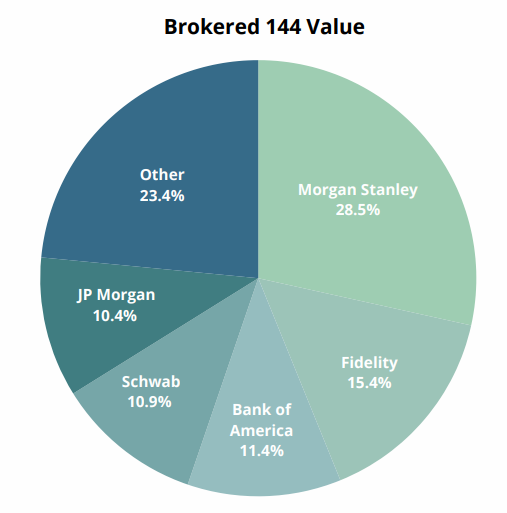

Top 5 Brokers for January 2025

As see in the chart, Morgan Stanley once again claimed top place for all metrics in January. Fidelity reclaimed a spot in the Top 5 last month, placing second across the board, and boosted by their role in brokering last month’s largest filing (see next page). Bank of America and Charles Schwab advanced to third and fourth place, respectively; Bank of America also claimed third for filings brokered this month. While JP Morgan ranked third in December, they slid into fifth place in value brokered last month.

Top Filers for January 2025

| Filer | Company | Broker | Value(M) | Shares(M) |

| Harbor Island Joint Rev Trust | Oracle Corp - [ORCL] | Fidelity | $705.5 | 3.81* |

| Mark Zuckerberg | Meta Platforms - [META] | Charles Schwab | $426.2 | 0.67* |

| His Majesty's Treasury | NatWest Group plc - [NWG] | Morgan Stanley | $396.3 | 40.27 |

*Pursuant to Rule 10b5-1