January 2026 144 Market Report

Aggregate 144 Market Volume

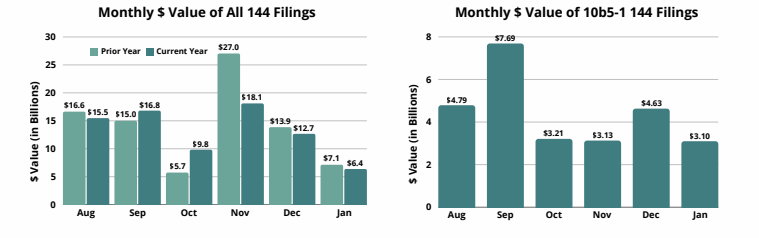

In January 2026, the total reported value of the 144 market fell 50% from December, accompanied by decreases in number of filings and shares of 36% and 6%, respectively. However, this is not unexpected, as there is typically a slowdown in the 144 market in January due in part to pre-earnings blackout periods. A similar decline in value of the 144 market can be seen from December 2024 to January 2025 as well. In comparison to January 2025, the reported value of discretionary filings last month rose 17%, whereas the number of non-planned shares surged nearly 100% year-over-year.

Top Brokers for January 2026

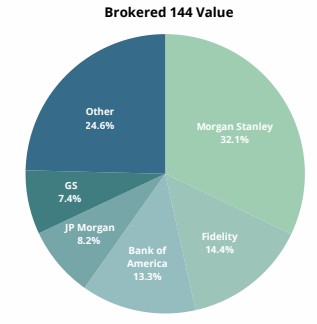

Morgan Stanley once again claimed top place for value and number of filings brokered in January. Fidelity rose through the rankings, placing second for value brokered, and boosted by their role in brokering one of last month’s largest filings (see next page). Bank of America claimed third place for all metrics last month. JP Morgan dropped back to fourth place in value from their third place finish in December. Finally, Goldman Sachs dropped to fifth place, rounding out the Top 5 Brokers for January.

Top Filers for January 2026

| Filer | Company | Broker | Value(M) | Shares(M) |

| Image Frame Investment (HK) Ltd | Kanzhun Ltd - [BZ] | Morgan Stanley | $415.4 | 19.48 |

| Michael Henriksen | Livento Group - [LIVG] | Fidelity | $350.0 | 100.00 |

| Edge Autonomy Ultimate Holdings LP | Redwire Corp - [RDW] | Bank of America | $225.9 | 19.99 |