July 2025 144 Market Report

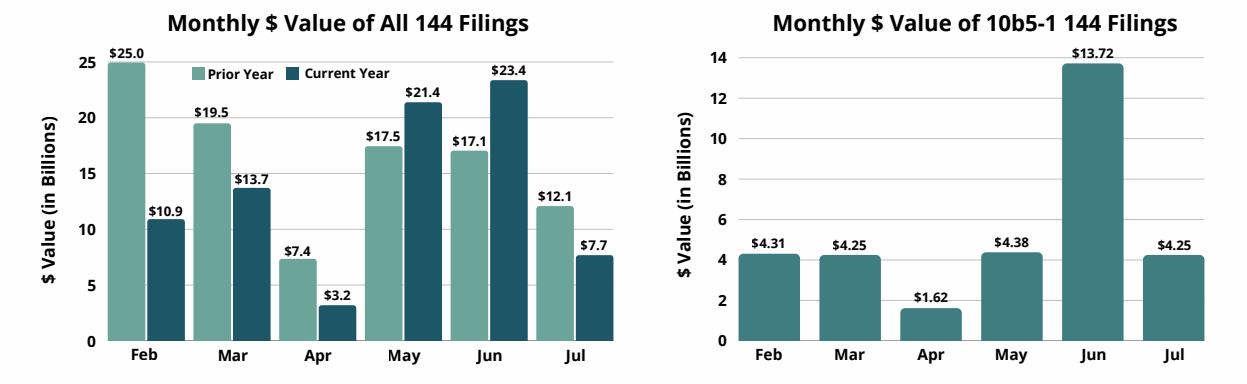

Aggregate 144 Market Volume

In July 2025, the total reported value of Form 144s fell 67% from the month prior, alongside a 65% and 36% drop in shares registered and number of filings, respectively. This overall slow-down is not surprising since July is typically a slow month due to pre-earnings blackout periods. When comparing July 2025 to July 2024, there was a 36% decrease in the value of Form 144s, driven by a 47% decline in the value of planned filings. There were similarly fewer shares transacted pursuant to a Rule 10b5-1 plan, a decline of 32% from the prior year. However, this year’s figures for value and shares registered seem to be more in line with the usual July 144 market activity from prior years. This may simply reflect a return to normal following last year’s AI-induced boom in the July 144 market.

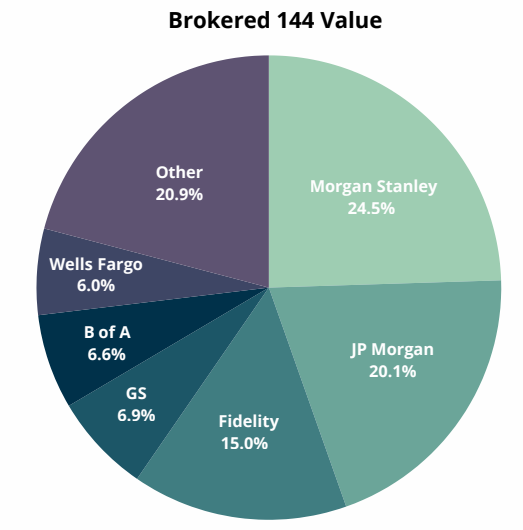

Top 5 Brokers for July 2025

In July, Morgan Stanley once again claimed first place in value brokered, as well as shares brokered and number of filings. JP Morgan advanced to second place from its fifth place spot in June, due in part to their role in brokering one of last month’s largest filings. Fidelity remained in third place for value brokered, but took second for number of filings. Goldman Sachs maintained fourth place for value, while Bank of America slid to fifth place.

Top 144 Filers of July 2025

| Filer | Company | Broker | Value(M) | Shares(M) |

| Leon D. Black | Apollo Global Management - [APO] | Wells Fargo | $456.0 | 3.00 |

| Ernest & Elizabeth Garcia | Carvana Co - [CVNA] | JP Morgan | $348.9 | 1.00* |

| Frank Slootman | Snowflake - [SNOW] | Fidelity | $297.0 | 1.34* |

(*Pursuant to Rule 10b5-1)