June 2025 144 Market Report

Aggregate 144 Market Volume

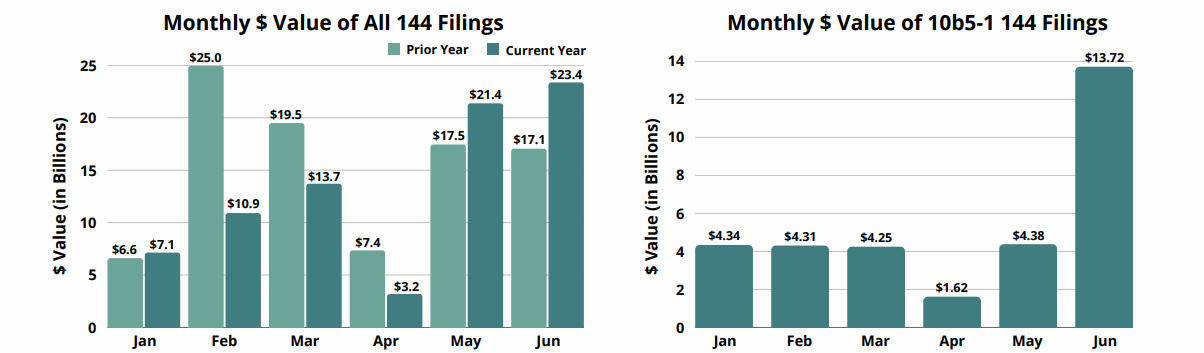

The total reported value of Form 144s pursuant to Rule 10b5-1 climbed a staggering 213% from May 2025 to June 2025, contrasted by a 43% decline in the value of discretionary filings. This rise exceeds the 169% increase in planned sales over the same period last year. The month-over-month increase of over 150% for the number of shares filed for sale on 10b5-1 filings also demonstrates a clear rise in planned behavior across multiple metrics.

In comparison to June 2024, the total reported value rose 37%, driven by increases in the value of both discretionary and planned filings. The year-over-year rise may reflect insiders’ decision to lock in profits after the market’s impressive recovery from April’s tariff-related dip and subsequent advancement to new heights.

[View Full Market Report Here]

Top 5 Brokers for June 2025

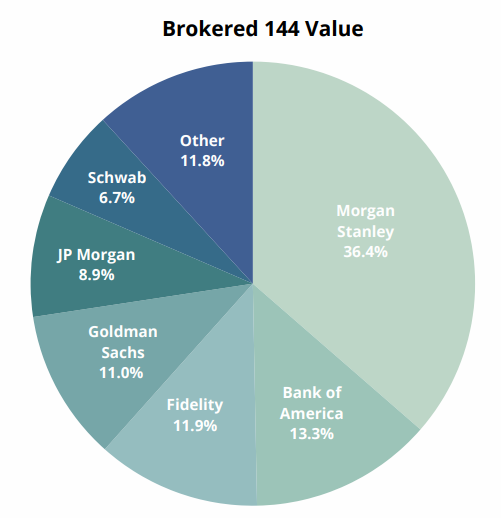

This past month, Morgan Stanley claimed first place in value brokered and filings once again, while also climbing to first in shares brokered from its second place spot in May. Bank of America rose through the ranks to take second place, from its spot in sixth the previous month, due to its role in brokering multiple of last month's largest filings (see next page). Fidelity advanced to third place, while Goldman Sachs slid to fourth. JP Morgan rounded out June's top 5 brokers in fifth place.

Top 144 Filers of June 2025

| Filer | Company | Broker | Value(M) | Shares(M) |

| Jeffrey P. Bezos | Amazon.com - [AMZN] | Morgan Stanley | $5,428.0 | 25.00* |

| Harbor Island Joint Rev Trust | Oracle Corp - [ORCL] | Fidelity | $1,825.9 | 8.69* |

| Michael Saul Dell | Dell Technologies - [DELL] | Bank of America | $1,222.7 | 10.00 |

(*Pursuant to Rule 10b5-1)