March 2025 144 Market Report

Aggregate 144 Market Volume

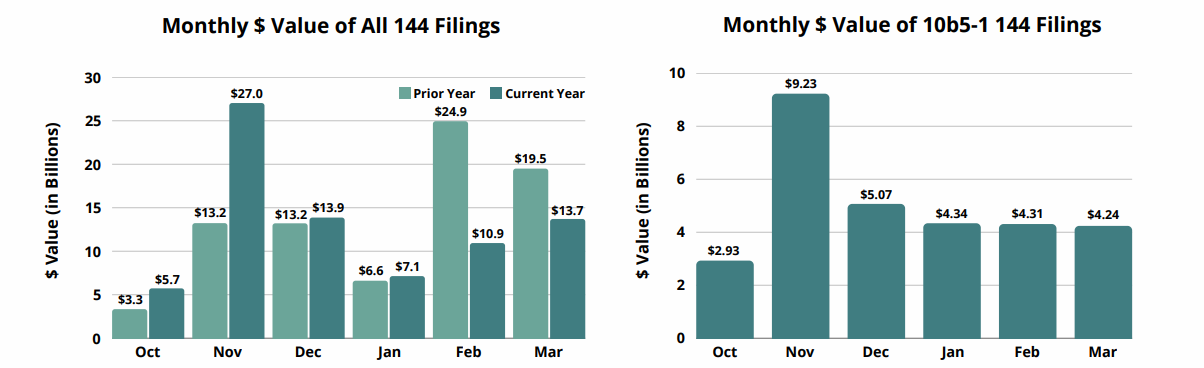

In March, the total reported value of Form 144s increased 25% from February, in conjunction with a 43% and 135% rise in the value and number of shares for discretionary filings, respectively. This contrasts with last year, which instead saw a monthover-month decrease in the overall value of the 144 market. Additionally, there was a marginal decrease in the value of 10b5-1 filings compared to the prior month. When comparing March 2025 to March 2024, there was a fall in Form 144 activity across the board: total value (-30%), number of shares (-22%), and filings (-22%). This indicates a trend reversal from the past two years when these metrics have seen a year-over-year rise, as the market reached new heights; this decrease may show hesitancy from insiders as various policies, such as tariffs, are announced by the new administration in Washington.

[View Full Market Report Here]

Top 5 Brokers for March 2025

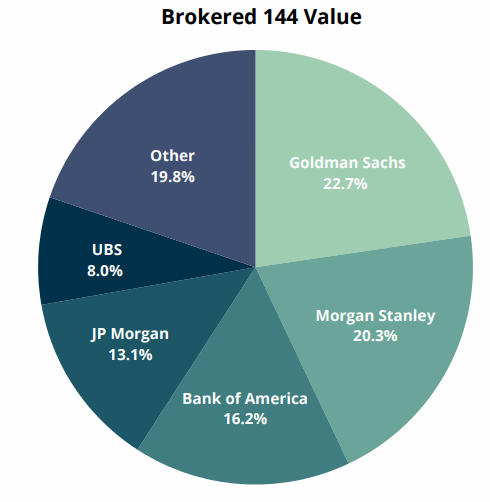

This March, Goldman Sachs claimed first place in value brokered, a significant bump from its sixth position in February. This was due to their role in brokering multiple of last month’s largest filings (see next page). Morgan Stanley remained in second, while securing first for the number of filings. Bank of America took third place in value, as well as first for the number of shares brokered. JP Morgan fell to fourth from its top position in February. UBS rounded out March’s top brokers in fifth place.

Top 144 Filers for March 2025

| Filer | Company | Broker | Value(M) | Shares(M) |

| Walton Family Holdings Trust | Walmart - [WMT] | Goldman Sachs | $1,234.6 | 13.00 |

| European Refreshments Unlimited Co | Coca-Cola Europacific Partners plc - [CCEP] | Bank of America | $774.4 | 8.98 |

| HHLR Advisors Ltd. | BeiGene - [ONC] | Goldman Sachs | $674.1 | 2.48 |